RIYADH: A unified regional carbon market is increasingly likely as Saudi Arabia takes the lead in this growing area of sustainability, experts have told Arab News.

Through Vision 2030, the Kingdom’s investments in renewable energy, advanced carbon capture technologies, and a regulated carbon credit market are growing, driving innovation in these areas.

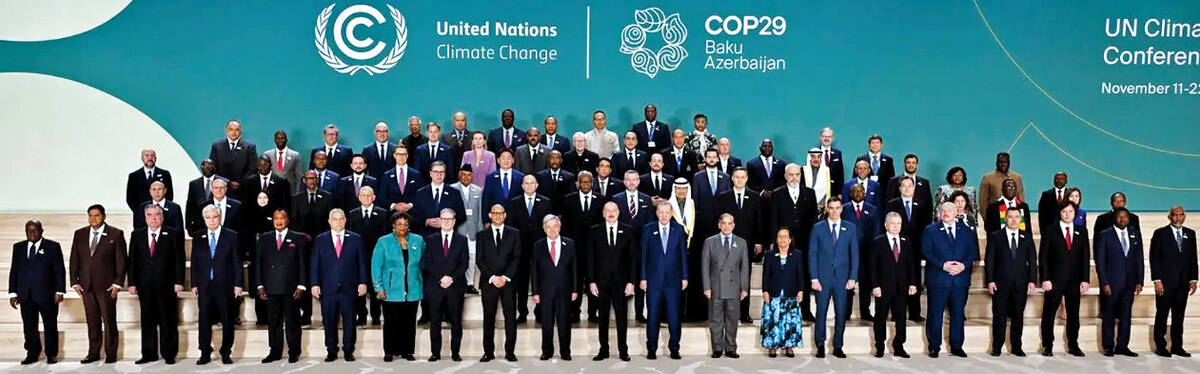

At the UN Climate Change Conference in Baku on Nov. 12, Saudi Arabia launched its first carbon trading exchange — a platform that places the Kingdom at the forefront of the GCC in this field.

Managed by the Regional Voluntary Carbon Market Co. — a joint initiative by the Public Investment Fund and the Saudi Tadawul Group — the exchange underscores Saudi Arabia’s commitment to sustainability and establishes a model of environmental responsibility for neighboring nations.

The inaugural auction on the exchange brought together 22 local and international companies offering 2.5 million high-quality carbon credits, certified by leading standards like Verra, Gold Standard, and Puro.earth.

These credits largely originate from impactful projects across the Global South, including countries such as Bangladesh, Brazil, and Ethiopia.

The market, projected to grow at a compound annual growth rate of 32.2 percent and reach $3.27 billion by 2030, will also drive investment in carbon capture, storage, and emissions reduction.

“Saudi Arabia is following a careful approach in setting up a carbon market and avoiding the mistakes made by the EU and other regions. Investing in voluntary carbon markets is a part of the Kingdom’s efforts to diversify its economy and achieve its goal of net-zero emissions by 2060,” explained Arun Leslie John, chief market analyst at Century Financial.

At the UN Climate Change Conference in Baku, KSA launched its first carbon trading exchange. (Supplied)

He added: “By establishing a domestic exchange and regulated marketplace for carbon credits, Saudi Arabia is leading the way for local companies to mitigate reputational risk in an increasingly cleaner energy generating world along with generally boosting liquidity conditions.”

The RVCMC has auctioned high-quality credits supporting projects with measurable environmental impact, most notably through initiatives in Africa, where it sold over 1.4 million tons of carbon credits in its first carbon offset auction in 2022.

Approximately 70 percent of these credits were allocated to climate projects across Africa, benefiting countries like Egypt, Mauritania, and South Africa.

Saudi Arabia’s commitment to stringent standards and regulatory oversight in its carbon credit market is setting a benchmark for other GCC countries. Unlike other regional markets, the Kingdom prioritizes quality and transparency.

“By developing standardized frameworks aligned with global benchmarks, the Kingdom can tackle the issue of lack of standardization, ensuring consistency and reliability across the market,” Louay Saleh, principal at Arthur D. Little, told Arab News.

Saleh added: “Saudi Arabia can ensure real impact and limit greenwashing by leveraging advanced technologies such as drones, satellite imaging, and AI. These tools can provide more accurate baselining and measurement throughout the project lifecycle, enhancing transparency and accountability”.

This dedication to transparency strengthens Saudi Arabia’s carbon market and positions it as an attractive destination for international investors, encouraging other GCC nations to adopt similar standards.

Economic opportunities and new revenue streams

The carbon credit market offers substantial economic potential for Saudi Arabia.

The energy sector, including companies like Aramco, is investing in carbon capture and storage technologies that allow them to generate tradable credits.

Investing in voluntary carbon markets is a part of the Kingdom’s efforts to diversify its economy and achieve its goal of net-zero emissions by 2060.

Arun Leslie John, chief market analyst at Century Financial

This potential extends beyond energy to other sectors, such as petrochemicals, aviation, and construction, which could reduce emissions through clean technologies and sell excess carbon credits.

“Industries such as petrochemicals, aviation, construction, agriculture and tourism in Saudi Arabia are most likely to benefit from or contribute to the carbon credit market,” emphasized Saleh, highlighting the extensive opportunities for both new revenue and emission reductions across these sectors.

In parallel with the growth of its carbon credit market, Saudi Arabia has attracted substantial foreign investment through green finance incentives. Programs like the Saudi Green Initiative and the Middle East Green Initiative, paired with green bond issuance, have provided essential funding for renewable energy and carbon capture projects.

The Kingdom aims to achieve a carbon capture capacity of 44 million tons annually by 2025, enhancing its ability to offset emissions and solidify its position as a high-quality carbon credit provider.

A vision for regional cooperation and the unified GCC carbon market

Saudi Arabia’s leadership in the carbon credit market is poised to significantly influence the GCC, as some regional countries are already reinforcing their market frameworks, suggesting the potential for a unified market.

“The outlook for a unified GCC carbon credit market is promising, with Saudi Arabia, the UAE, and Oman making significant steps forward in their respective carbon market infrastructures,” said Carlo Stella, managing partner and global head of sustainability practice at Arthur D. Little.

“Regional cooperation is very likely to facilitate key aspects such as standardization of methodologies, cross-border trading mechanisms, and the development of a shared carbon registry system,” he added.

By developing standardized frameworks, KSA can tackle the issue of lack of standardization, ensuring consistency across the market.

Louay Saleh, principal at Arthur D. Little

Through Vision 2030, Saudi Arabia’s investments in renewable energy, advanced carbon capture technologies, and a regulated carbon credit market are positioning it as a leader in climate action within the GCC, demonstrating that economic growth and sustainability can go hand in hand.

The Kingdom’s carbon credit initiatives are shaping not only its own future but also setting a model for the GCC to follow toward a more sustainable path.

Poised to play a pivotal role in global sustainability, Saudi Arabia’s carbon credit market — driven by large-scale projects, cutting-edge technology, and a commitment to transparency — is leading the GCC on a transformative journey toward climate-responsible economic development.

Through these initiatives, the Kingdom is not only raising the bar for carbon markets but is also creating a blueprint for the region and beyond in green finance and environmental responsibility.